In recent years, the accounting landscape for software investments has evolved significantly, offering businesses more flexibility in how they capitalize expenses related to software development and cloud services. For CIOs and finance leaders alike, understanding these changes is critical for leveraging investments effectively while adhering to updated financial standards.

What Is Software Capitalization?

Software capitalization refers to the process of treating certain software development or acquisition costs as capital expenditures rather than operational expenses. By capitalizing these costs, businesses can spread the expenses over the useful life of the software, aligning better with its long-term value and reducing the impact on short-term profitability.

Key expenses eligible for capitalization include:

• Development costs for internal-use software

• Costs associated with cloud implementation and migration

• Customization or configuration of software solutions

Recent Changes in Capitalization Standards

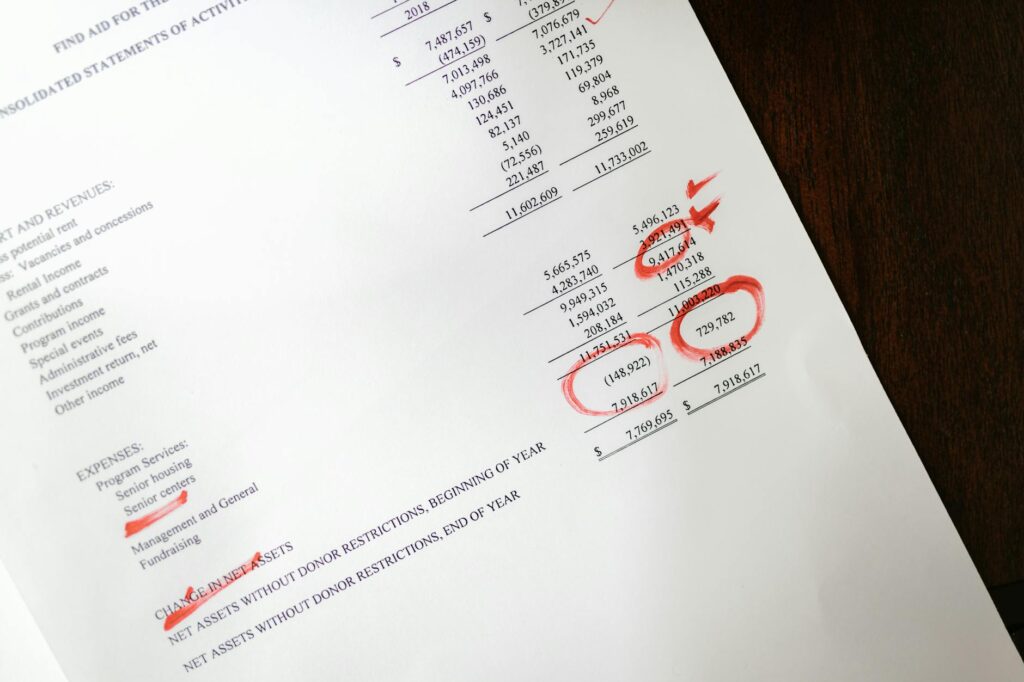

One of the significant updates in recent years stems from guidance provided by the Financial Accounting Standards Board (FASB). The new standards specifically address the treatment of implementation costs for cloud computing arrangements (CCAs). These costs, previously treated as operational expenses, can now often be capitalized if they meet certain criteria.

According to FASB Accounting Standards Update (ASU) 2018-15, companies can capitalize implementation costs related to CCAs, provided these costs are incurred during the application development phase and are directly related to preparing the software for its intended use (source).

Implications for CIOs

As a CIO at Drummond, I’ve observed firsthand how these changes can benefit organizations with significant investments in software and cloud technologies. For instance, during the implementation of Drummond’s proprietary Wavelength platform, we worked closely with finance to evaluate which implementation and development costs could be capitalized. By leveraging the updated guidelines, we were able to amortize these costs over time, preserving operational budgets for other IT innovations.

This approach enabled:

• Better financial alignment between IT and finance departments

• Enhanced clarity in IT project budgeting

• Improved reporting on technology ROI

How to Determine What Can Be Capitalized

1. Identify the Eligible Costs: Costs associated with software design, coding, testing, and configuration during the development phase are typically eligible for capitalization. However, costs incurred during the research or post-implementation phases, such as training and maintenance, are not.

2. Collaborate with Finance: Regular collaboration with your finance team is essential. At Drummond, we established a clear framework to categorize expenses accurately during large-scale IT projects.

3. Document Thoroughly: Maintaining detailed documentation is critical to ensure compliance. This includes tracking costs by phase, purpose, and project milestones.

Challenges and Considerations

While the flexibility in capitalization is beneficial, it does come with challenges:

• Complexity in Classification: Differentiating between phases of software development can be tricky. A clear understanding of FASB guidelines is crucial.

• Impact on Financial Metrics: Capitalizing expenses improves short-term profitability but increases amortization expenses in future periods. Businesses need to evaluate the trade-offs.

• Cloud Evolution: As cloud technology evolves, so do the associated accounting practices. Staying informed about updates is a constant need for CIOs.

Best Practices for CIOs

1. Integrate Financial Acumen into IT Leadership: As CIOs, our role is no longer confined to technology alone. Partnering with finance teams ensures that IT investments align with broader business goals.

2. Utilize Cloud Tools Strategically: Cloud-based accounting platforms can help automate the categorization of expenses, making it easier to identify capitalizable costs.

3. Keep Stakeholders Educated: Periodically updating your leadership team on how these changes impact financial reporting and technology budgets helps build trust and transparency.

Looking Ahead

The accounting standards around software capitalization will continue to evolve as organizations increasingly adopt cloud-first and hybrid strategies. By staying ahead of these changes, CIOs can play a pivotal role in ensuring that their organizations maximize the financial benefits of their technology investments while maintaining compliance.

For Drummond, the ability to capitalize significant portions of our cloud and software implementation projects has been instrumental in balancing short-term financial demands with long-term innovation goals. As we continue to innovate, understanding these accounting nuances will remain a cornerstone of strategic IT planning.

Sources:

- Financial Accounting Standards Board (FASB) – www.fasb.org

- Journal of Accountancy: “How Cloud Computing Changes Accounting Practices” – www.journalofaccountancy.com